The solar industry has seen unprecedented growth over the past decade, thanks to increasing environmental awareness, government incentives, and falling costs of solar technology. Among the major components influencing the solar energy ecosystem is the import duty on solar panel. For investors, developers, and even homeowners, understanding the structure and implications of this duty is crucial.

Table of Contents

In this comprehensive guide, we’ll break down everything you need to know about the import duty on solar panel, its impact on pricing, the government’s policy rationale, exemptions, country-specific regulations, and the road ahead.

What is Import Duty on Solar Panel?

As of April 2025, India imposes import duties on solar panels to promote domestic manufacturing and reduce reliance on foreign imports. These duties are part of the government’s broader strategy to enhance self-reliance in the renewable energy sector.

Current Import Duty Structure:

- Basic Customs Duty (BCD): India has reduced the BCD on imported solar cells from 25% to 20%, and on solar modules from 40% to 20%

- Agriculture Infrastructure and Development Cess (AIDC): Introduced to fund agricultural infrastructure, the AIDC is applied at 7.5% for solar cells and 20% for solar modules.

- Social Welfare Surcharge (SWS): An additional surcharge of 2.5% for solar cells and 4% for solar modules is levied .

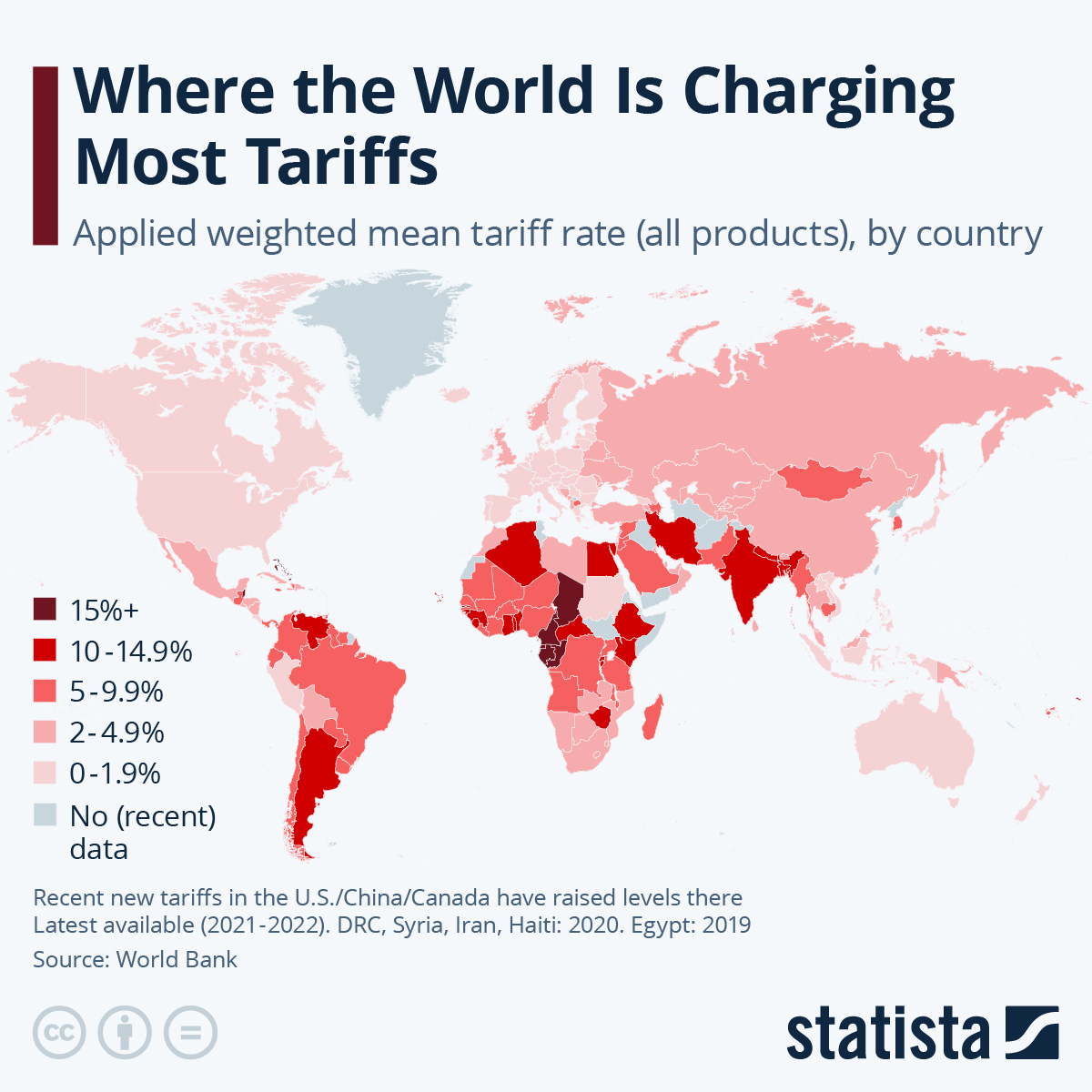

The Global Landscape of Solar Panel Import Duties

As countries around the world accelerate their shift toward renewable energy, solar panels are at the forefront of this transition. However, import duties on solar panels vary greatly across regions, reflecting differing national strategies on trade, energy security, and domestic industry development.

United States

The U.S. has intensified tariffs on solar imports, particularly targeting Chinese products:

- Section 301 Tariffs: Increased from 25% to 50% on Chinese crystalline silicon photovoltaic (CSPV) cells and modules, effective August 2024, to address alleged unfair trade practices.

- Section 201 Safeguard Tariffs: A 14.25% tariff applies to CSPV cells and modules from most countries, with an exemption for the first 5 GW of CSPV cell imports annually.

- Anti-Dumping Duties: Imposed on imports from Southeast Asian countries—Vietnam (271.28%), Cambodia (125.37%), Thailand (77.85%), and Malaysia (21.31%)—to counteract alleged market flooding with underpriced solar goods

European Union

The EU’s import duty structure is relatively balanced:

- Anti-Dumping Duties: Previously imposed on Chinese imports but lifted in 2018. As of now, no blanket import duties, but scrutiny remains high.

- Carbon Border Adjustment Mechanism (CBAM) (effective 2026): This new mechanism will impose carbon-based tariffs on imports, including solar panels with high embodied emissions..

India

- Basic Customs Duty (BCD): Reduced from 40% to 20% on solar modules and from 25% to 20% on solar cells.

- Agriculture Infrastructure and Development Cess (AIDC): Introduced at 20% for modules and 7.5% for cells.

- Social Welfare Surcharge (SWS): Applied at 4% for modules and 2.5% for cells.

India’s approach to the import duty on solar panel is one of the most significant in the world due to its aggressive push for solar self-reliance.

China

China, the world’s largest producer and exporter of solar panels, imposes low to no import duties on solar modules. Instead, it focuses on:

- Exporting solar components globally

- Providing subsidies and incentives to its domestic manufacturers

- Maintaining a dominant share in the global solar value chain

Australia

Australia maintains a low-duty environment for solar panel imports:

- Most panels are imported (predominantly from China)

- No anti-dumping tariffs currently in place

- Government emphasis is on incentivizing adoption rather than regulating supply chains

Why is Import Duty on Solar Panel Important?

Understanding the import duty on solar panel is vital for several reasons:

- Cost Planning: Developers can forecast project costs accurately.

- Policy Compliance: Ensures that your imports comply with government rules.

- Investment Decisions: Helps in comparing domestic versus imported modules.

- Supply Chain Strategy: Informs sourcing and procurement choices.

Import duties directly affect the landed cost of solar panels, which in turn impacts the levelized cost of electricity (LCOE) from solar installations.

India’s Import Duty on Solar Panel: A Deep Dive

Recent Changes in Import Duties

In the Union Budget 2025-26, India announced a reduction in the Basic Customs Duty (BCD) on solar cells and modules from 40% to 20%. This move aims to make solar energy more affordable while continuing to support domestic manufacturing efforts.

Promoting Domestic Manufacturing

The reduction in import duties is expected to encourage the growth of India’s domestic solar manufacturing sector. By making imported components more affordable, the government aims to stimulate local production and reduce dependency on foreign imports.

Balancing Trade and Industry Needs

While the duty reduction makes imports more cost-effective, it also presents challenges. Domestic manufacturers may face increased competition from cheaper imported panels, potentially impacting local production. Therefore, the government is likely to implement measures to support domestic industries, such as incentives for local manufacturing and quality standards.

Aligning with Sustainability Goals

This policy shift aligns with India’s broader sustainability objectives. By making solar energy more accessible, the government aims to accelerate the adoption of renewable energy sources, contributing to the country’s climate commitments and energy transition goals.

Market Dynamics and Future Outlook

The reduction in import duties is anticipated to influence market dynamics. While it may lead to increased imports, the concurrent push for domestic manufacturing is expected to create a balanced growth trajectory for the solar industry. Ongoing policy support and investment in infrastructure will be crucial in sustaining this momentum.

Historical Context of India’s Import Duty on Solar Panels

India’s approach to import duties on solar panels has evolved over the years, reflecting a balance between promoting domestic manufacturing, ensuring energy security, and meeting sustainability goals. Here’s an overview of the key developments:

Early Years: Encouraging Solar Adoption

In the early 2010s, India’s solar industry was nascent, with limited domestic manufacturing capabilities. To promote solar adoption, the government reduced import duties on solar panels, making them more affordable for developers and consumers.

2018: Introduction of Safeguard Duty

In July 2018, India imposed a 25% safeguard duty on solar cells and modules imported from China and Malaysia. This move aimed to protect domestic manufacturers from a surge in imports, which were perceived as being sold at unfairly low prices.

2022: Significant Increase in Import Duties

On April 1, 2022, India implemented a substantial increase in import duties: 40% on solar modules and 25% on solar cells. This policy aimed to reduce dependency on Chinese imports and encourage local manufacturing. However, it also led to an increase in the cost of solar energy projects, as developers faced higher equipment costs.

2023: Consideration of Duty Exemptions

In early 2023, the government considered exempting up to 30 GW of solar projects from these import duties. This proposal aimed to address the shortfall in domestic manufacturing capacity and meet the growing demand for solar energy.

2025: Reduction in Import Duties

In the Union Budget 2025-26, India announced a reduction in import duties: 20% on solar modules and 20% on solar cells. This move sought to make solar energy more affordable while continuing to support domestic manufacturing efforts.

Ongoing Challenges

Despite these policy adjustments, challenges remain. India’s domestic manufacturing capacity still falls short of the growing demand for solar energy components. The reliance on imports continues, and the industry faces issues related to supply chain constraints and project delays.

The government is actively working to address these challenges through initiatives aimed at boosting domestic production and reducing reliance on imports. The future of India’s solar industry will depend on the successful implementation of these strategies and the ability to balance import duties with the need for affordable solar energy solutions.

Current Rates (as of 2025)

| Item | Basic Customs Duty (BCD) | Agriculture Infrastructure and Development Cess (AIDC) | Social Welfare Surcharge (SWS) | Effective Total Duty |

|---|---|---|---|---|

| Solar Cells | 20% | 7.5% | 2.5% | 30% |

| Solar Modules | 20% | 20% | 4% | 44% |

Key Notes

- The import duty on solar panel is applicable even if the importer is a government entity.

- No exemptions are provided under concessional duty schemes like EPCG or SEZ post-2022.

- Imported panels under older contracts may be exempt under grandfathering clauses.

Impact of Import Duty on Solar Panel Prices in India

| Component | Estimated Price Increase | Reason |

|---|---|---|

| Imported Panels | ₹0.80 to ₹0.90 per Wp | Due to the 20% Basic Customs Duty (BCD) |

| Domestic Panels | ₹2 to ₹2.5 per Wp | Increased costs of raw materials and domestic production expenses |

Factor Effects of Import Duty on Solar Panel in India

1. Boost in Domestic Manufacturing

Indian solar component manufacturers, represented by organizations such as the Solar Ancillary Manufacturers’ Association, have voiced their concerns regarding the Import Duty on Solar Panels. They argue that inexpensive imports from countries like China and Vietnam are often priced below domestic production costs, which undermines local industries. These imports, which bypass local manufacturing, can weaken the domestic market. In response, manufacturers are urging the government to impose higher tariffs and anti-dumping duties to level the playing field, ensuring that the Import Duty on Solar Panel supports local production while fostering industry growth.

2. Increase in Project Costs

Despite the reduction in Basic Customs Duty (BCD) on solar modules from 40% to 20% and on solar cells from 25% to 20%, the introduction of additional duties like the Agriculture Infrastructure and Development Cess (AIDC) has led to an overall increase in project costs. Developers are facing higher expenses, which could impact the affordability and pace of solar energy adoption.

3. Shift in Sourcing Strategy

The Import Duty on Solar Panels has prompted many developers to rethink their sourcing strategies. In response to rising import costs, there’s an increased focus on forming partnerships with domestic manufacturers, which helps mitigate the risks of fluctuating import duties and supply chain disruptions. This strategic shift in sourcing aims to reduce the impact of the Import Duty on Solar Panels and ensure that projects remain cost-effective.

4. Delays in Solar Project Execution

The increase in import duties and the adjustments in sourcing strategies have led to delays in solar project executions. These delays are impacting India’s renewable energy rollout and the ability to meet ambitious clean energy adoption targets. The Import Duty on Solar Panel has thus become a significant factor influencing project timelines and overall energy goals.

5. Rise of Alternative Technologies and Hybrid Projects

In light of the changing economic landscape, developers are increasingly exploring alternative technologies and hybrid solutions to reduce reliance on imported components. These innovations aim to maintain project viability despite the challenges posed by the Import Duty on Solar Panels. Hybrid projects, which combine solar with other renewable energy technologies, are emerging as a promising solution.

6. Pressure on Rooftop Solar Segment

The Import Duty on Solar Panels has put additional pressure on the rooftop solar market, especially in the residential and small-to-medium enterprise sectors. These segments are highly sensitive to price changes, and the increased costs due to import duties are making it harder for consumers to afford rooftop solar installations. The Import Duty on Solar Panels in this market segment could slow down the adoption of residential and commercial solar systems, potentially delaying broader energy transitions.

7. Revenue Generation and Fiscal Benefits

While the Import Duty on Solar Panels creates financial challenges for developers, it also provides significant revenue to the government. This revenue can be reinvested into clean energy initiatives and renewable energy programs, thus contributing to the development of India’s renewable energy sector. In this way, the Import Duty on Solar Panels aligns with broader fiscal policies that support long-term sustainability goals.

8. Realignment of Global Trade Relations

The adjustments in import duties reflect India’s efforts to balance domestic industry protection with global trade dynamics. These changes are influencing international trade relations and may lead to new partnerships and agreements in the renewable energy sector.

In conclusion, the Import Duty on Solar Panels plays a crucial role in shaping the future of India’s solar energy landscape. While it provides protection to domestic manufacturers and generates government revenue, it also presents challenges for project developers and the renewable energy industry. For further insights or assistance in navigating the complexities of the solar industry, contact us at Soleos Solar to learn more about how the Import Duty on Solar Panels affects your projects.

Import Duty Exemptions and Concessions

| Item | Duty Status | Details |

|---|---|---|

| Solar Cells & Modules | Basic Customs Duty (BCD): 20% | Reduced from 25% (cells) and 40% (modules) to promote domestic manufacturing and reduce costs for solar projects. |

| Agriculture Infrastructure and Development Cess (AIDC) | Modules: 20% Cells: 7.5% | Introduced to offset revenue loss from BCD reductions. |

| Solar Glass | Customs Duty: 10% (effective from October 1, 2024) | Imposed to encourage domestic production, as India has sufficient manufacturing capacity. |

| Tinned Copper Interconnects | Customs Duty: 5% (effective from October 1, 2024) | Duty imposed due to adequate domestic supply. |

| Capital Goods for Solar Manufacturing | Duty Exemption: Yes | Specified machinery/equipment used in solar cell and module production are exempt from BCD. |

| Solar Power Projects (Concessional Duty) | Concessional Rate: 5% | Under Section 157 of the Customs Tariff Act, entities importing all components for a solar project against specific contracts may qualify for a concessional import duty rate. |

| Duty-Free Import Scheme (MOOWR) | Discontinued | The scheme allowing duty-free imports for solar power generation equipment via customs-bonded warehouses was revoked in December 2024 to encourage domestic manufacturing. |

The Role of ALMM in Solar Panel Imports in India

The Approved List of Models and Manufacturers (ALMM) is a policy by India’s Ministry of New and Renewable Energy (MNRE) to ensure that only high-quality solar panels are used in government-supported projects.

Key Points:

- Reduces Imports: Encourages the use of domestically produced solar panels, reducing reliance on imports.

- Boosts Local Manufacturing: Supports India’s “Make in India” initiative by promoting local solar manufacturers.

- Ensures Quality: Only panels meeting strict quality standards are eligible for government projects.

- Works with Import Duties: Along with import duties, ALMM helps make imported panels less competitive, encouraging local production.

Impact:

- Quality Control: Ensures only reliable, efficient panels are used in projects.

- Job Creation: More local manufacturing leads to increased employment.

- Cost: While it may raise the cost of solar installations initially, it helps lower long-term costs by boosting local production.

Country-wise Import Duty Comparison

| Region/Country | Average Tariff Rate |

|---|---|

| United States | 22.5% – 24% |

| European Union | ~5% |

| China | ~9% |

| India | ~13% |

| Brazil | ~13% |

| South Africa | ~11% |

| Australia | ~5% |

| Singapore | 0% |

| Hong Kong | 0% |

Future Outlook of Import Duty on Solar Panel

| Category | Details |

|---|---|

| Import Duty (2025) | Solar Modules: 20% (reduced from 40%) Solar Cells: 20% (reduced from 25%) |

| Purpose of Reduction | Make solar panels cheaper, support more solar adoption |

| Upcoming Changes (Future Outlook) | Reviewing extra surcharges (7.5%–20%) for possible reduction |

| PLI Scheme Support | ₹24,000 crore allocated to boost domestic solar manufacturing |

| ALMM Rule (from June 2026) | Only Indian-made solar panels & cells allowed in government solar projects |

| Expected Market Demand (2025) | 35–40 GW of solar energy capacity needed |

| Benefit to Consumers | Lower costs for installing solar systems at home or business |

| Goal of Policy | Balance between affordable solar and promoting local manufacturing |

Pros and Cons of Imposing Import Duty on Solar Panels

Pros

- Boosts Domestic Manufacturing

Import duties make foreign solar panels more expensive, giving Indian manufacturers a competitive edge. This encourages local production and reduces dependence on imports. - Creates Employment Opportunities

More local manufacturing means more jobs in India, especially in the renewable energy and solar sectors. - Improves Energy Security

By producing solar panels domestically, India becomes less dependent on countries like China for its energy needs. - Encourages Technological Innovation

With increased government focus and support, Indian companies are investing in research and development to create high-quality, efficient solar products. - Supports Government Initiatives

Import duties align with national programs like the PLI Scheme, which aim to promote self-reliance (Atmanirbhar Bharat) in key sectors.

Cons

- Raises Project Costs

Higher import duties increase the cost of imported panels, which raises the total cost of solar installations — especially for developers who rely on foreign equipment. - Slows Down Solar Adoption

Expensive panels may slow down the adoption of solar energy among businesses, industries, and households that are sensitive to price. - Limited Local Capacity

While India is ramping up solar manufacturing, it still cannot fully meet the high demand. This gap can lead to project delays or shortages. - Quality and Efficiency Challenges

Imported solar panels are often more efficient and technologically advanced. Rapidly growing domestic production may face quality or performance issues in the short term. - Risk of International Trade Tensions

Imposing high duties on imports might lead to trade disputes or retaliatory actions from other countries, especially major exporters like China.

Expert Insights: Industry Response to Import Duties

Solar industry leaders have had mixed reactions to the import duty on solar panel:

1. Domestic manufacturers

Indian manufacturers, represented by associations like the Solar Ancillary Manufacturers’ Association, have raised concerns about the influx of low-cost imports, particularly from countries like China and Vietnam. These imports often come at prices lower than the cost of domestic production, making it difficult for local industries to compete. To protect domestic manufacturers, these bodies advocate for the imposition of additional measures such as anti-dumping duties and domestic content mandates. They believe that such protections are crucial for the growth of domestic manufacturing and for ensuring fair competition.

2. Project developers

On the flip side, solar project developers have voiced concerns that the import duty on solar panels increases the overall cost of solar projects, which can delay the implementation of renewable energy projects. The removal of duty-free schemes has disrupted financial planning, forcing developers to adjust their power purchase agreements and potentially slowing down India’s push towards solar energy adoption.

3. Government’s Approach

In an effort to strike a balance, the Indian government has made strides in adjusting import duty on solar panels. As per the 2025 Union Budget, the duty on solar modules was reduced from 40% to 20%, and the duty on solar cells was cut from 25% to 20%. These changes aim to make solar projects more financially viable while still fostering the growth of domestic manufacturing.

In conclusion, the import duty on solar panels remains a complex issue that requires a balanced approach. While it is essential to support domestic manufacturing, it is equally important to ensure that the cost of solar energy remains affordable for project developers and consumers. As the government continues to fine-tune its policies, it is crucial to strike a balance that encourages both local production and widespread solar adoption.

Frequently Asked Questions (FAQs)

1. What is import duty on solar panel in India?

A: Import duty on solar panel refers to the tax imposed by the Indian government on importing solar modules and solar cells from other countries. As of 2025, the rate is 20% on both solar modules and solar cells.

2. Why does India impose import duty on solar panels?

A: India imposes import duties to protect and promote its domestic solar manufacturing industry. This policy supports the “Make in India” and “Atmanirbhar Bharat” initiatives, reducing dependency on foreign imports, especially from China.

3. How has the import duty on solar panels changed over time?

A: Earlier, India levied a 40% duty on solar modules and 25% on solar cells (introduced in 2022). However, in Union Budget 2025, the government reduced both to 20% to balance manufacturing promotion with cost-effective solar deployment.

4. Who benefits from the import duty on solar panels?

A: Local solar manufacturers benefit the most, as the duty makes imported panels more expensive. This allows domestic products to become more competitive in price and demand.

5. How does import duty affect solar project costs?

A: Higher import duty increases the cost of imported panels, which in turn raises the overall project cost for solar installations. This can impact project feasibility, especially for utility-scale solar developers.

6. Are there any exemptions to the import duty on solar panels?

A: In certain cases, the government may provide exemptions or concessional duties, especially for public sector projects or under specific renewable energy policies. However, such exemptions are limited and project-specific.

7. What is the ALMM and how does it relate to import duty?

A: ALMM (Approved List of Models and Manufacturers) is a list maintained by the MNRE (Ministry of New and Renewable Energy) to ensure only approved solar products are used in government-backed projects. ALMM works alongside import duty to encourage the use of domestically made panels.

8. Which countries export solar panels to India?

A: India imports solar panels mainly from China, Malaysia, Vietnam, and Thailand. Import duties are especially aimed at reducing reliance on these countries for critical solar components.

9. Is there a difference in import duty between solar modules and solar cells?

A: Currently, both solar modules and solar cells have the same import duty rate—20% as of 2025.

10. Will the import duty on solar panels change in the future?

A: Possibly. The government reviews duty structures based on industry feedback, trade agreements, and energy targets. Future budgets may raise, reduce, or restructure import duties to suit India’s clean energy goals.

Conclusion: Navigating the Import Duty on Solar Panel in 2025

The Import Duty on Solar Panel in India continues to be a crucial lever in shaping the nation’s solar journey. While it empowers domestic manufacturers and supports the vision of Atmanirbhar Bharat, it also impacts pricing and accessibility for developers and consumers. As the landscape evolves, staying informed about policy shifts is essential for making strategic decisions in the solar sector.

Whether you’re a business investing in solar, a homeowner considering rooftop solutions, or a stakeholder in the renewable industry, understanding the implications of Import Duty on Solar Panel is key to optimizing cost and ensuring long-term value.

At Soleos Solar, we help you navigate this complexity with clarity and confidence. From policy guidance to cutting-edge solar solutions, we’re here to support your sustainable transition. Get in touch with Soleos Solar today and let’s build a brighter, cleaner future together—powered by smart decisions and the sun.