As the global economy marches toward a future powered by renewable energy, India is emerging as a powerhouse in solar manufacturing. For leaders in large manufacturing units seeking to cut costs, enhance sustainability, and secure energy independence, understanding the landscape of solar panel manufacturers in India isn’t just informative—it’s strategic.

Table of Contents

This comprehensive blog explores the Indian solar manufacturing ecosystem in depth: the key players, technologies, policy frameworks, supply chains, quality standards, cost dynamics, and how decision-makers can confidently navigate procurement and deployment for their industrial operations.

Why Solar Manufacturing in India Matters Now

India is entering a pivotal phase in its energy evolution — and solar manufacturing sits at the heart of this transformation. For decision-makers in large manufacturing units, understanding this shift isn’t just informative — it’s strategic.

1. Powering India’s Clean Energy Ambition

India has set ambitious goals for renewable energy, targeting 500 GW of non-fossil fuel capacity by 2030, with solar energy as a central element of this strategy. The sector is experiencing rapid growth across utility-scale, commercial, and industrial domains. The acceleration of local solar manufacturing is crucial to this transition, as it reduces reliance on imports, thereby facilitating quicker, more affordable, and more predictable deployment of clean energy.

2. Reducing Import Dependence and Supply Chain Risks

Historically, India has relied heavily on importing solar cells and modules, which subjected solar projects to global supply chain disruptions and currency risks. In response, India is developing a domestic solar manufacturing ecosystem, transitioning from reliance on imports to self-reliance. This shift aims to stabilize supply chains and reduce lead times for industrial solar deployments. Such self-reliance offers protection to large energy consumers from fluctuations in foreign markets, providing significant advantages in long-term planning and cost management.

3. Strong Policy Support and Strategic Incentives

Indian policymakers have established a comprehensive framework to enhance solar manufacturing in the country. The Production Linked Incentive (PLI) scheme promotes investments in high-efficiency solar module production. Additionally, Domestic Content Requirements and the Approved List of Models and Manufacturers (ALMM) play a crucial role in ensuring quality and creating demand for domestically produced solar panels. By imposing customs duties on imports, the government protects local manufacturers and stimulates investments in upstream capabilities. These policies are not merely temporary measures; they function as structural enablers, fostering growth and confidence throughout the solar value chain.

4. Growing Domestic Manufacturing Capacity

India’s solar manufacturing capacity has significantly increased from a few gigawatts to an anticipated 200 GW for modules and 100 GW for cells by 2028. This expansion facilitates faster large-scale solar deployments, shortens project development timelines, and achieves competitive pricing through economies of scale. Consequently, industrial energy buyers benefit from improved availability and pricing certainty.

5. Competitive Edge in Global Supply Chains

India is increasingly recognized as a significant manufacturing hub, aligning with global strategies such as “China Plus One,” which encourages businesses to diversify their sourcing. As India expands its manufacturing capabilities, it experiences growth in export opportunities, improvement in manufacturing quality, and acceleration in innovation. This evolution enhances India’s appeal as a reliable supplier within the global solar ecosystem, allowing both Indian manufacturers and major energy consumers to capitalize on global demand trends.

6. Job Creation and Economic Growth

The solar manufacturing drive presents significant economic advantages by generating thousands of jobs in various sectors including fabrication, assembly, logistics, and quality testing. Initiatives such as the Production-Linked Incentive (PLI) scheme and state-level incentives have already resulted in the creation of tens of thousands of new manufacturing jobs. This growth not only bolsters local economies but also fosters the development of a skilled workforce essential for sustaining long-term energy infrastructure.

7. Control Over Quality, Technology, and Innovation

Domestic manufacturing enables Indian companies to customize solar products to suit local climate challenges, such as extreme heat, dust, and monsoon variability, while also incorporating advanced technologies like PERC, TOPCon, and bifacial modules. This results in higher performance, lower degradation, and improved lifecycle value of solar systems. For industrial users, these benefits lead to predictable power generation and enhanced return on investment (ROI).

Understanding Solar Panel Technologies

India’s solar panel manufacturers are the backbone of the country’s rapidly expanding renewable energy ecosystem. They play a critical role in transforming sunlight into reliable, cost-effective electricity—especially for large manufacturing units seeking long-term energy security, lower operating costs, and stronger sustainability credentials. Understanding how these manufacturers operate, innovate, and deliver value helps industrial decision-makers make confident, future-ready investments.

What Solar Panel Manufacturers Do

Solar panel manufacturers in India are engaged in the entire process of photovoltaic (PV) module development, which includes designing, producing, assembling, and testing. They typically operate across various stages of the solar value chain, which involves:

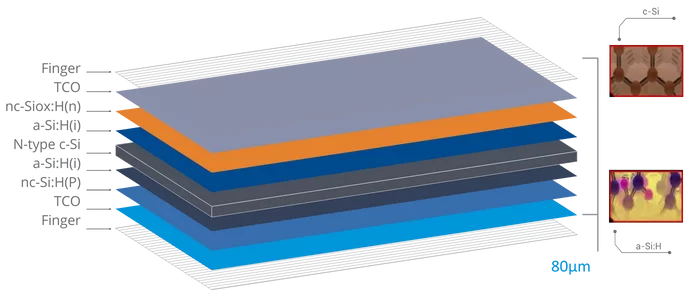

- Solar Cell Production or Sourcing: Manufacturers either produce or source solar cells using advanced technologies such as Monocrystalline PERC, TOPCon, and bifacial designs.

- Module Assembly: The solar cells are then encapsulated, laminated, framed, and electrically tested to create durable and high-performance solar panels.

- Quality Control and Certification: The assembled modules undergo extensive testing to assess their heat resistance, mechanical strength, and electrical performance, assuring consistent functionality for over 25 years.

Recently, many Indian manufacturers are shifting towards integrated manufacturing by expanding from solely module assembly into solar cell production. This development aims to enhance quality control and ensure supply reliability.

Why Solar Panel Manufacturers in India Matter

The growing significance of Indian solar manufacturers can be attributed to several key strategic factors. First, there is an increase in industrial demand as large manufacturing units turn to solar energy to counter rising power costs and fulfill ESG commitments. Second, reduced import dependence allows domestic manufacturers to minimize risks associated with global supply chain disruptions, currency fluctuations, and logistics delays. Lastly, Indian manufacturers achieve cost competitiveness through economies of scale, automation, and government incentives, allowing them to provide competitive prices without sacrificing quality. For industrial energy buyers, these developments promise predictable timelines, stable costs, and enhanced long-term operational confidence.

Technologies Powering Indian Solar Manufacturing

Indian solar panel manufacturers provide a diverse range of advanced technologies for industrial and utility-scale applications. Key offerings include monocrystalline solar panels, which excel in efficiency and performance, particularly for space-constrained environments like factory rooftops. Bifacial solar panels are designed to capture sunlight from both sides, enhancing overall energy yield and making them suitable for ground-mounted installations and solar carports. Additionally, advanced cell technologies such as PERC and TOPCon have been developed to operate efficiently under high temperatures and low-light conditions, which is particularly beneficial for the Indian climate. These technological advancements result in increased energy generation, reduced degradation over time, and improved lifecycle returns for consumers.

Quality Standards and Reliability

Reputed solar panel manufacturers in India comply with national and international standards such as BIS and IEC certifications. Many are listed under approved government frameworks, ensuring safety, durability, and bankability. For manufacturing companies, this reduces performance risk and ensures dependable energy output for decades.

What Industrial Buyers Should Focus On

Understanding solar panel manufacturers is crucial for industries to make informed decisions that extend beyond mere pricing and emphasize long-term value. Key evaluation criteria include the manufacturers’ production capacity and future technology developments, the efficiency of the solar modules and their performance in various temperatures, the presence of relevant certifications alongside warranties and degradation rates, and the quality of after-sales service and reliability over time.

India’s Solar Manufacturing Landscape

India’s solar manufacturing landscape is rapidly evolving from a limited module-assembly market into a robust, high-capacity, and technology-driven industrial ecosystem. This transformation is positioning the country as a key global player in renewable energy supply chains. For industrial leaders, the rise of domestic Solar Panel Manufacturers is reshaping how solar projects are sourced, priced, financed, and deployed across commercial and manufacturing operations.

1. Rapid Expansion of Manufacturing Capacity

India has witnessed exceptional growth in solar module and cell production over the past few years. By the end of 2024, the country’s cumulative solar module manufacturing capacity reached approximately 90.9 GW, while solar cell capacity grew to nearly 25 GW—a sharp rise from earlier levels. In just the first half of 2025, India added another 44.2 GW of module capacity and 7.5 GW of cell capacity, driven by strong policy backing and robust demand from industrial and utility-scale projects.

This expansion highlights how Indian Solar Panel Manufacturers are scaling rapidly to meet both domestic energy needs and global demand. Under the Production Linked Incentive (PLI) scheme, nearly 48 GW of PV module manufacturing capacity has already been allocated, with additional capacity under development—signaling India’s long-term commitment to manufacturing leadership.

2. Geographical Hubs of Solar Manufacturing

India’s solar manufacturing growth is geographically diverse, reducing regional risk and improving supply chain resilience. Gujarat has emerged as a dominant hub, leading in both solar module and cell production and accounting for a significant share of national output. Rajasthan, Tamil Nadu, and Uttar Pradesh have become key centers for module manufacturing, while Karnataka and Telangana play an important role in cell production. This distributed manufacturing footprint strengthens the ecosystem for Solar Panel Manufacturers, ensuring consistent supply availability and faster delivery timelines for industrial solar projects across the country.

3. Technological Progress and Industrial Upgrading

India’s solar manufacturing sector is not just expanding—it is upgrading technologically. Many Solar Panel Manufacturers now produce modules based on larger M10 and G12 wafer formats, enabling higher efficiencies and improved power output. Monocrystalline technology continues to dominate, while investments in TOPCon and next-generation cell technologies are accelerating.

Indian manufacturers are increasingly aligning with global quality benchmarks, which enhances confidence among industrial buyers. This technological advancement is critical for maximizing energy yield, reducing degradation, and delivering strong long-term returns on investment for large manufacturing units.

4. Policy Support as a Growth Engine

Government initiatives have been instrumental in shaping India’s solar manufacturing ecosystem. The Production Linked Incentive (PLI) Scheme has emerged as a major catalyst, encouraging Solar Panel Manufacturers to invest in high-efficiency modules and integrated manufacturing capabilities. Under PLI Tranche-II, nearly 39,600 MW of domestic solar PV module capacity has been allocated, driving capital investment, job creation, and technological innovation. Complementary frameworks such as the Approved List of Models and Manufacturers (ALMM) ensure quality compliance and enable domestic manufacturers to participate in government and institutional projects. Together, these policies are helping Solar Panel Manufacturers reduce import dependency, strengthen local supply chains, and build a future-ready manufacturing ecosystem.

5. Balancing Domestic Growth and Market Dynamics

As India’s solar manufacturing capacity grows rapidly, the market is entering a more competitive phase. While domestic capacity expansion enhances supply security, it also encourages manufacturers to differentiate through efficiency, quality, and service reliability. For industrial buyers, this competition among Solar Panel Manufacturers leads to better pricing, improved technology access, and stronger after-sales support—key factors for long-term energy planning.

6. What This Means for Industrial Energy Buyers

For manufacturing units transitioning to solar energy, the current landscape offers several advantages: reliable local supply with short lead times, competitive pricing bolstered by policy incentives, adherence to quality and performance standards, and increased scale and choice from diverse manufacturers. This mature domestic ecosystem facilitates the design of solar solutions that are not only cost-efficient and high-performing but also aligned with sustainability goals.

Top Solar Panel Manufacturers in India

Here’s a detailed look at leading Indian solar panel manufacturers trusted for industrial and commercial projects:

1. Waaree Energies Ltd.

Waaree, located in Mumbai, Maharashtra, stands as one of India’s largest solar panel manufacturers, boasting an annual module capacity exceeding 15 GW across multiple plants. The company offers a broad spectrum of photovoltaic (PV) modules, including monocrystalline, N-type, HJT, bifacial, and flexible variants. As the leading domestic solar module producer in India, Waaree’s products cater to various applications such as rooftop installations, industrial projects, and utility-scale developments. The company’s strong commitment to quality control and backward integration enhances its operational capabilities. Waaree has established a significant global presence, serving industrial, commercial, and utility-scale clients with reliable solar solutions characterized by superior quality and diverse offerings.

2. Soleos Energy Private Limited

Over the past 12 years, Soleos has developed a portfolio exceeding 450 MW and has specialized in commercial and industrial (C&I) rooftop solar, ground-mount systems, and solar parks. The company has a global presence in countries including Spain, Portugal, the United Kingdom, the United Arab Emirates, Germany, and various regions in Africa. By 2024, Soleos accomplished over 120 projects, with more than 350 MW of solar capacity installed and commissioned. The firm, headquartered in Ahmedabad, Gujarat, India, executes large-scale projects worldwide, including a notable 200 MW solar park in the Democratic Republic of Congo, which is projected to be commissioned by late 2026.

3. Adani Solar

Adani Solar, a component of the Adani Group’s clean energy ecosystem, is a rapidly expanding, vertically integrated solar panel manufacturers located in Ahmedabad, Gujarat. The company is focused on a significant expansion toward a capacity of 10 GW and beyond, producing high-efficiency mono PERC and TOPCon modules. Its importance lies in its comprehensive value-chain presence, which encompasses the production of cells, modules, and various other components.

Adani Solar benefits from competitive pricing due to robust manufacturing automation and possesses substantial capacity for both utility-scale and industrial applications. The firm’s strategy emphasizes building capacity across the entire manufacturing spectrum—from ingots and wafers to cells and modules—while catering to both domestic and international markets, establishing a strategic manufacturing footprint in India.

4. Tata Power Solar Systems Ltd.

Tata Power Solar, based in Bengaluru and Noida, is a highly regarded Solar Panel Manufacturers in India, boasting decades of experience across various segments including commercial, industrial, residential, and utility markets. The company is recognized for its extensive expertise in Engineering, Procurement, and Construction (EPC), as well as project execution. Its solar panels are specifically optimized for Indian weather conditions, ensuring proven reliability alongside strong after-sales support. Tata Power Solar’s manufacturing facilities focus on producing efficient mono-PERC modules, reflecting the company’s commitment to high quality and effective execution.

5. Vikram Solar Pvt. Ltd.

A Tier-1 Solar Panel Manufacturers, Vikram Solar, is globally recognized for its export-ready modules and commitment to high-efficiency technologies such as HJT (Heterojunction Technology) and n-type cells. The company has established itself as a preferred supplier for quality-focused buyers, particularly in industrial and utility projects, having executed over 275 projects with a cumulative capacity of 1.03 GW across 39 countries, which highlights its substantial international presence. Notably, in 2023, Vikram Solar commissioned a significant 300 MW solar project in Nokhra, Rajasthan, which is among the largest single-site photovoltaic projects in Uttar Pradesh. For the fiscal year 2023-24, the company reported revenues of INR 25,109.90 million and employed 1,513 people, indicating strong growth and operational scale.

6. RenewSys India Pvt. Ltd.

RenewSys is a leading integrated solar panel manufacturers in India, specializing in the production of not only solar panels but also key photovoltaic (PV) components, including encapsulants and backsheets. This upstream integration allows RenewSys to maintain higher quality control and ensure stable supply for industrial applications, enhancing overall performance and reliability in solar energy deployments.

7. Goldi Solar

Goldi Solar is an emerging Solar Panel Manufacturers recognized for its robust and export-ready solar modules. The company specializes in high-efficiency module types, including monocrystalline and bifacial options that cater to both rooftop and ground-mounted installations. As it rapidly expands its capacity, Goldi Solar aims to meet increasing demand in the solar energy market.

Quality Standards and Certifications to Know

When evaluating Solar Panel Manufacturers, quality standards and certifications are not just technical checkboxes—they are critical indicators of long-term performance, safety, and bankability. For industrial and commercial buyers, choosing certified solar panels directly impacts energy yield, asset life, and return on investment.

1. IEC Certifications: The Global Benchmark

IEC (International Electrotechnical Commission) standards are essential for ensuring the safety and performance of solar modules, particularly for bankable projects. Key standards include:

- IEC 61215 / IS 14286: Focuses on design qualification and type approval, confirming long-term outdoor performance.

- IEC 61730 (Parts 1 & 2): Establishes safety design and testing requirements for photovoltaic (PV) modules, emphasizing electrical safety, fire resistance, and insulation reliability.

- IEC 61701: Conducts a salt mist corrosion test to evaluate environmental resistance.

- IEC 62716: Tests modules for ammonia corrosion.

- IEC 61853: Assesses performance under varying irradiance and temperature conditions.

Additionally, other rigorous tests account for dust, humidity, temperature cycling, and transport durability. Compliance with IEC standards is crucial as it guarantees that solar panels can reliably perform across various climates, making them ideal for industrial rooftops and solar parks. Esteemed solar panel manufacturers adhere to these standards, ensuring their products are well-suited for industrial rooftops, ground-mounted plants, and utility-scale applications globally.

2. BIS Certification: Mandatory for India

The Bureau of Indian Standards (BIS) certification, particularly under IS 14286 for crystalline silicon photovoltaic (PV) modules, is a mandatory requirement for all solar panels sold or deployed in India. This certification ensures that solar panels meet essential safety and performance standards applicable in Indian conditions. It is crucial for legal market access, ensuring that panels adhere to basic safety, structural integrity, and electrical performance requirements. Solar panels lacking BIS certification should be avoided in formal tenders and contracts.

For Indian manufacturers utilizing solar energy, BIS-certified panels guarantee compliance with national regulations, eligibility for government and institutional projects, and diminish the risk of purchasing substandard or counterfeit products. Reputable solar panel manufacturers consistently maintain active BIS registration for their module models, reflecting their commitment to quality and standards compliance.

3. ALMM Listing: Critical for Government & Large Projects

The Approved List of Models and Manufacturers (ALMM) is a quality-assurance list maintained by the Ministry of New and Renewable Energy (MNRE) in India, which certifies manufacturers who adhere to proper documentation, consistent production practices, and traceable quality systems. The ALMM is crucial for government-backed solar initiatives, public sector projects, and significant commercial and industrial tenders. It enhances procurement confidence by reducing the risk of substandard solar modules and provides industrial buyers with assurance regarding the origin, quality control, and policy compliance of the solar panels they procure.

4. ISO Certifications: Manufacturing Excellence

Leading solar panel manufacturers typically possess several ISO certifications that signify their commitment to quality and safety in production. The key certifications include ISO 9001:2015 for Quality Management Systems, ISO 14001:2015 for Environmental Management Systems, and ISO 45001 for Occupational Health and Safety. These certifications signify that manufacturers adhere to consistent and audited processes within their facilities, rather than testing individual panels, which is essential for ensuring consistent quality across large production batches. The presence of such standards enhances operational discipline and minimizes variability in panel quality for large-scale projects.

5. TÜV, UL, and Third-Party Testing

Independent third-party certifications from agencies like TÜV Rheinland and SolarPTL ensure solar panel performance under real-world and stress conditions, including long-term energy output, high-temperature and humidity tolerance, corrosion, mechanical stress, and outdoor performance verification. These tests confirm that modules meet or exceed their rated performance, essential for bankability. Bodies such as TÜV Rheinland, TÜV Süd, and UL provide validation through rigorous tests like thermal cycling, PID resistance, and mechanical load tests. Industrial buyers should select manufacturers whose modules have passed extensive third-party testing beyond the basic requirements.

Cost and Supply Chain Considerations

Understanding cost dynamics and supply chain realities is essential when evaluating Solar Panel Manufacturers. These factors influence module pricing, project timelines, warranty commitments, and overall ROI — especially for large manufacturing units planning rooftop, ground-mount, or captive solar installations.

1. Supply Chain Structure — India’s Ongoing Import Dependence

India’s solar supply chain is heavily reliant on imported upstream materials, primarily polysilicon and wafers, as domestic production remains limited. This dependency leads to price fluctuations driven by global markets and logistics, affecting module pricing and project timelines. Disruptions such as trade restrictions or shipping delays can significantly impact solar projects. To address these risks, strong solar panel manufacturers adopt strategies like developing multiple supplier networks, engaging in backward integration, planning inventory in accordance with project pipelines, and establishing localized manufacturing and warehousing. For large-scale solar installations, ensuring supply reliability is critical alongside cost considerations.

2. Raw Material Costs Drive a Large Share of Panel Pricing

Raw materials significantly impact the total cost of solar modules, with polysilicon, wafers, and cells being major cost components due to imports and international pricing pressures. The costs of other materials like glass, frames, encapsulants, and silver paste vary based on duties and local sourcing. Fluctuations in key materials such as aluminum and silicon influence panel pricing, making it essential for industrial buyers to consider these trends for long-term solar procurement budgeting.

The price set by solar panel manufacturers is determined by interconnected factors beyond wattage, including the costs of raw materials, cell and module technologies (Mono-PERC, TOPCon, bifacial, n-type), manufacturing scale, quality standards, and warranties. Low-cost panels lacking quality assurance may lead to higher degradation and operational costs. Thus, reputable manufacturers prioritize competitive pricing alongside long-term performance, essential for calculating industrial return on investment (ROI).

3. Capital Intensity and Integration Costs

Expanding manufacturing in India from module assembly to include cell, wafer, and polysilicon production demands significant capital investment, with a fully integrated facility being much costlier than a module plant. This capital intensity restricts supply chain development, causing many Indian Solar Panel Manufacturers to depend on imports and affecting their pricing control. However, India’s domestic manufacturing has enhanced cost predictability, offering benefits like reduced exposure to international price fluctuations, lower logistics costs, faster delivery times, and decreased import reliance. Supported by government initiatives like PLI and ALMM, domestic manufacturers are achieving economies of scale that stabilize pricing without sacrificing quality.

4. Logistics, Lead Times and Infrastructure

Efficient supply chains are crucial for timely solar panel delivery, as delays from customs, congestion, and transport issues can disrupt project schedules and increase overall costs. Industrial buyers should assess supply reliability and logistics capabilities alongside pricing, as delays may escalate labor, financing, and opportunity expenses. Preferred manufacturers provide shorter lead times, predictable delivery, and effective coordination with EPC and O&M teams, minimizing risks in critical projects.

5. Policy Impacts on Cost and Supply Chains

India’s Production Linked Incentive (PLI) scheme promotes domestic investment in solar module and cell capacity, enhancing self-reliance. However, complexities arise from policy asymmetries, import regulations for polysilicon and wafers, and limited incentive coverage. Proposed policies aim to encourage domestic sourcing but require gradual implementation. Stable policies are crucial for reducing price volatility and supporting supply chain predictability. Supply chain disruptions from trade issues or geopolitical events can impact project timelines, hence strong solar panel manufacturers use multiple supplier networks, backward integration, inventory planning, and localized manufacturing to ensure reliability, which is essential for large-scale solar installations.

Government Policies and Incentives

India’s policy environment actively promotes solar manufacturing:

- Production Linked Incentive (PLI) Scheme: The Production Linked Incentive (PLI) Scheme is a key initiative by India’s Ministry of New and Renewable Energy to enhance the solar manufacturing sector. It provides financial incentives to manufacturers of high-efficiency solar PV modules for production and sales over five years. The scheme aims to build large-scale domestic manufacturing, attract advanced technologies, promote local material sourcing, create jobs, and enhance competitiveness against imports. Key benefits include incentivizing large-scale production, fostering vertical integration, improving cost competitiveness, and ensuring supply security. The government has committed substantial financial support to boost manufacturing capacity, attracting investments from both domestic and international players.

- ALMM Framework: Ensuring Quality and Traceability: The Approved List of Models and Manufacturers (ALMM), managed by MNRE, is a compliance framework that certifies solar modules and manufacturers for government and institutional projects. Inclusion in the ALMM indicates verified quality and documentation, facilitates participation in significant contracts, and promotes local manufacturing. The government plans to extend ALMM to solar cells, enhancing quality standards. ALMM ensures domestic manufacturing, enforces standards, mitigates the risk of substandard imports, and increases procurement transparency. Many tenders now require ALMM-listed modules, making it vital for solar project planning.

- Basic Customs Duty (BCD): Supporting Domestic Manufacturing: India has implemented a Basic Customs Duty (BCD) of 20% on imported solar cells and modules to protect and promote domestic Solar Panel Manufacturers. This adjustment lowers previous higher duty rates, making local production more competitive against imports. Additional charges, such as the Agriculture Infrastructure and Development Cess (AIDC) and Social Welfare Surcharge, may still be applicable. However, certain machinery and capital goods necessary for manufacturing are exempted from customs duty to encourage the establishment of fabrication facilities. These measures aim to create a level playing field for domestic manufacturers and stimulate local production investments. The BCD significantly alters market dynamics by enhancing the competitiveness of Indian manufacturers, promoting local sourcing, and accelerating domestic production capacity. While it may affect short-term pricing, BCD ultimately strengthens long-term supply resilience and diminishes reliance on global supply chains.

- Domestic Content Requirements (DCR): Under certain government solar initiatives, like the MNRE’s CPSU Phase-II and grid-connected rooftop solar programs, there are Domestic Content Requirements (DCR) that necessitate the use of domestically produced solar cells and modules to qualify for subsidies. This requirement stimulates local manufacturing demand and bolsters Solar Panel Manufacturers within the country. The push for domestic content not only prompts these manufacturers to invest in local facilities and cultivate Indian supply chains but also fosters job creation and skill development. For industrial buyers prioritizing environmental, social, and governance (ESG) criteria and sustainability objectives, procuring from domestic sources advances both the energy transition and boosts national manufacturing growth.

These policies reduce costs and accelerate deployment—especially attractive for large commercial and industrial energy consumers.

How to Choose the Right Manufacturer for Your Project

Here’s a decision-making framework tailored to industrial buyers:

Step 1: Define Your Energy Needs

- To successfully initiate a solar project, it is essential to first clarify the project’s objectives. This involves analyzing current electricity consumption, peak demand hours, and seasonal load patterns. Additionally, the available installation space—such as rooftops, ground mounts, or carports—along with future expansion considerations should be taken into account. Establishing these parameters from the outset allows for the selection of Solar Panel Manufacturers whose products align with specific energy targets, space limitations, and operational needs. For manufacturing facilities, utilizing high-efficiency panels is particularly crucial to optimize output while ensuring operational continuity.

Step 2: Assess Total Cost of Ownership

- Upfront panel cost represents just one aspect of the investment in solar panels. A comprehensive evaluation should emphasize the Total Cost of Ownership (TCO), which incorporates long-term performance and risk considerations spanning over 25 years. Essential factors to assess include module efficiency, degradation rates, warranties for both product and performance, maintenance needs, and anticipated energy yield. Reputable Solar Panel Manufacturers provide panels that ensure stable long-term output accompanied by robust warranty support, minimizing hidden costs and guaranteeing predictable savings throughout the lifespan of the system.

Step 3: Evaluate Technical Fit

- Not all solar panels exhibit the same performance across varying conditions, so it is crucial to evaluate if the manufacturer’s technology is suitable for your specific site and environmental factors. Essential certifications, such as BIS, IEC, and ALMM (if applicable), should be verified alongside performance data that reflects high-temperature, dusty, or humid conditions. Advanced technologies, including mono PERC, TOPCon, and bifacial modules, can notably enhance the output for industrial applications. Reputable solar panel manufacturers aim to design products that ensure reliability, safety, and efficiency when subjected to real-world operating environments.

Step 4: Check After-Sales Support

- A solar plant is considered a long-term asset, making comprehensive after-sales support essential for its protection. Key factors to assess include the manufacturer’s local service availability, the clarity of warranty terms, response times for technical issues, and the accessibility of replacement modules. Established solar panel manufacturers that boast robust after-sales networks and financial stability are able to effectively reduce downtime, facilitate warranty claims, and provide consistent system performance throughout the life of the project.

Future Outlook

The solar industry is poised for significant growth driven by technological advancements and increased global competition among Solar Panel Manufacturers. With rising renewable energy adoption, manufacturers are expanding production to meet demand from various sectors, particularly in India, which is emerging as a key manufacturing hub, facilitating both domestic use and exports. This expansion is expected to improve module availability, shorten project timelines, and stabilize pricing for large energy consumers. The industry is advancing towards high-efficiency technologies, shifting from conventional solar panels to innovations such as TOPCon, heterojunction, bifacial, and high-wattage models, optimizing energy output and ensuring reliability in high-temperature environments. This shift is especially beneficial for industrial applications requiring space efficiency and return on investment.

Moreover, there is a trend towards vertical integration in the solar supply chain, where manufacturers are investing in upstream capabilities like wafer and cell production to enhance supply chain resilience and quality control. This move minimizes dependence on imports and stabilizes costs, aiding long-term project planning. Digitalization and automation are transforming production processes, with AI-enabled quality checks and automated lines boosting manufacturing efficiency and consistency. These improvements support uniformity in module quality, increasing confidence in performance.

Sustainability is becoming a crucial focus, with manufacturers adopting eco-friendly production practices, responsible sourcing, and end-of-life solutions for solar modules, aligning with the ESG goals of businesses seeking cleaner energy. In conclusion, the solar manufacturing sector is moving towards consolidation, with innovative and financially robust manufacturers likely to dominate. This evolution promises industrial decision-makers enhanced access to higher-quality solar solutions, dependable suppliers, and greater assurance of long-term value, ultimately driving a cost-efficient and sustainable energy future.

Conclusion

The transition to solar energy has become a strategic imperative for modern manufacturing, and Solar Panel Manufacturers are at the heart of this transformation. With India’s solar manufacturing ecosystem rapidly advancing in scale, technology, and quality, industrial enterprises today have access to reliable, high-performance solar solutions that deliver long-term energy security and cost stability. Backed by strong policy support, advanced manufacturing processes, and globally aligned quality standards, Solar Panel Manufacturers are enabling factories to move away from volatile grid power and toward predictable, sustainable energy models.

By partnering with trusted Solar Panel Manufacturers, manufacturing units gain more than just clean electricity—they gain confidence. Confidence in consistent power generation, confidence in long-term warranties and after-sales support, and confidence in meeting sustainability and ESG commitments without compromising operational efficiency. As solar manufacturing continues to evolve, it will play a decisive role in building resilient, future-ready industries, ensuring that manufacturing growth is powered not only by energy, but by reliability, innovation, and solar confidence.

Frequently Asked Questions (FAQs) on Solar Panel Manufacturers

1. Who are Solar Panel Manufacturers?

Solar Panel Manufacturers are companies that design, produce, and test photovoltaic (PV) modules used to convert sunlight into electricity. Leading manufacturers focus on high efficiency, durability, and compliance with global quality standards to serve residential, commercial, and industrial solar projects.

2. Why is choosing the right Solar Panel Manufacturer important for industrial projects?

For industrial and commercial installations, the right Solar Panel Manufacturer ensures consistent energy output, long-term reliability, and strong return on investment. Quality manufacturing reduces risks related to panel degradation, downtime, and warranty claims over the 25–30 year lifecycle of a solar plant.

3. What certifications should Solar Panel Manufacturers have in India?

Reputed Solar Panel Manufacturers should comply with BIS certification, IEC standards (IEC 61215 & IEC 61730), and be listed under ALMM (Approved List of Models and Manufacturers) for government and large-scale projects. These certifications ensure safety, performance, and regulatory compliance.

4. How do Indian Solar Panel Manufacturers compare with global manufacturers?

Indian Solar Panel Manufacturers have rapidly improved in technology, capacity, and quality. With investments in advanced technologies like TOPCon and bifacial modules, many Indian manufacturers now meet global standards while offering cost advantages, shorter lead times, and strong local support.

5. What technologies are Solar Panel Manufacturers adopting today?

Modern Solar Panel Manufacturers are adopting high-efficiency technologies such as mono PERC, TOPCon, heterojunction (HJT), and bifacial modules. These technologies deliver higher energy yields, better temperature performance, and lower degradation—ideal for industrial applications.

6. How does the Production Linked Incentive (PLI) scheme support Solar Panel Manufacturers?

The PLI scheme encourages Solar Panel Manufacturers to set up large-scale, high-efficiency manufacturing facilities in India. It strengthens domestic supply chains, reduces import dependency, and improves quality and competitiveness for both domestic and export markets.

7. What should businesses consider beyond panel price when evaluating Solar Panel Manufacturers?

Beyond price, businesses should assess total cost of ownership, panel efficiency, degradation rate, warranty terms, financial stability of the manufacturer, supply reliability, and after-sales support. Trusted Solar Panel Manufacturers deliver better long-term savings despite slightly higher upfront costs.

8. Do Solar Panel Manufacturers offer long-term warranties?

Yes, established Solar Panel Manufacturers typically offer product warranties of 10–15 years and performance warranties of 25–30 years, ensuring reliable power generation and financial security for long-term solar investments.